UNITED STATES OF

AMERICA

BEFORE THE

FEDERAL ENERGY

REGULATORY COMMISSION

CAlifornians for Renewable Energy, Inc. ) Docket No. EL01-65-000

(CARE) )

Complainant )

v. )

BC Hydro, PowerEx, Southern Co. )

Energy

Marketing, now called Mirant, )

And the Bonneville Power

Administration )

)

Respondents )

COMPLAINT

Pursuant to Section 206 of

the Federal Power Act, 16 U.S.C. § 824e, and Rule 206 of the Commission’s Rules

of Practice and Procedure, 18 C.F.R. § 385.206, CAlifornians for Renewable

Energy, Inc. (CARE)[1] hereby

petitions the Commission to rectify unjust and unreasonable prices stemming

from the wholesale markets for energy and ancillary services operated by the

California Independent System Operator (CAISO), and investigate its

relationship to market practices by BC Hydro, PowerEx, Southern Co. Energy Marketing, now called Mirant,

and the Bonneville

Power Administration. CARE hereby

petitions the Commission make findings that BC Hydro, PowerEx, Mirant, and the Bonneville Power Administration violated the Federal Power Act by with holding power during a

period of peak demand to contrive an outage to create a shortage and test their

market power. CARE alleges that in addition to violations of the FPA these

market practices violated federal and state anti-trust laws, the civil rights

of Californians (now a majority minority population state) under Title VI of

the Civil Rights Act of 1964, and the international free trade law NAFTA. CARE

further alleges that these generators or marketers acted with impunity for

their actions irrespective of the loss of life and associated run-up in price

of power and the economic repercussions nationally that resulted. CARE contends that FERC’s

failure to determine the just and reasonable price of power and impose refunds

enabled these generators and marketers of power to contrive a now long-term

shortage of supply. To date California faces a repeat of the events and

circumstance of the June 14, 2000 outages[2],

but on a statewide and continuing basis, as the Investor Owned Utility PG&E

is now in bankruptcy. CARE calls on FERC to take immediate action to create

certainty in the market through the enforcement of its statutory responsibility

to protect consumers from unjust pricing, while protecting reliable delivery of

power. California, now faced with little or no imported power, faces a more

serious threat as other generators follow suit and withhold power through

planned and unplanned outages. As of this filing 13,000 megawatts of generation

remain off line, as California’s power markets are no longer reliable to meet

baseline demand of 35,000 megawatts. (35GWh) Immediate market incentives need

to be provided to encourage imports and in state production now. With

California facing rolling blackouts this summer FERC failure to immediately act

to rectify these existing market conditions will result in a nation wide

economic recession and the threat of the worst depression since the 1930s.

DISCUSSION

CARE contends that BC Hydro, PowerEx, Mirant[3], and the Bonneville Power Administration violated the Federal Power Act by with holding power during a period of peak demand to contrive an outage to create a shortage and test their market power. The evidence of these illegal activities is information provided by BC Hydro/PowerEx, the California ISO, and the LA Times.

CARE first became

aware of these matters and began our investigation on January 6, 2001 when we

intercepted from a YAHOO Message Board the following article from an alleged

power trader in Spokane Washington.

Canada Steels $3 billion from CA by: larstrader (39/M/Spokane, WA) 01/06/01 07:55

pm EST Msg: 2736 of 5810

Time for a little power lesson for those that want to point fingers at the real villan in CA energy fiasco. First, Powerex, the marketing arm for BC Hydro, has terminated all sales to CA for credit reasons. Second, their are two interties from BC to US (both in WA state). Total transfer capacity is close to 4,000 MW. Powerex purchased 2000MW of firm transmission rights from BPA for delivery into CA. Their rights are at NOB and COB (NW3 and NW1).

The lines are not "maxed" out, in fact they are

operating at less than

25% load factor. The reason

is simply the system is not tight right now. Energy everywhere other than CA,

is trading for $150-180, the PX is

$250-300. That is the credit premium the market in is charging CA.

The real story here is what Powerex did this year. BC Hydro has

over 10,000 MW of hydro capacity. They have multi-year storage capacity in

their reservoirs. This allows them to simply not generate and not sell if they

don't like the price. Powerex in the past has been the butt of jokes for their

incompetence in managing their resources to maximize their return. Many trades

made fortunes off of Powerex. Not this year.

Powerex locked up transmission, sold very little energy forward,

and became the swing resource in CA. If they didn't like the price, they didn't

sell, didn't generate, and stored their potential energy as water behind their

reservoirs. When the price was at the cap, they filled the lines from the

Canadian border to CA exporting all they could.

I estimate Powerex has earned over $3 billion this year off of

sales to CA and the PNW. This foreign country was the big winner this year, and

these people are the true energy bandits. More power to them, but the west has

paid dearly for their sudden increase in trading prowess.

Could CA help mitigate the energy crisis. Absolutely, they are

not regulated under FERC and have not been subject to Richardson's emergency

order. They are still selling spot in the PNW, but are not exporting to CA. In

effect, BPA is acting as the credit filter to CA for Powerex. They are picking

up the energy at MidC and wheeling to CA.

BC Hydro's incredible hydro system was financed in part by the US

back in the 40s-50s. There is an international treaty that exists between the

two countries that provides the US pay back BC Hydro thousands of MWs per year

for the reservoir capacity created upstream from Grand Coulee.

The US govt should tax

invoke an excise tax on imported energy from Canada to recoup the billions our

neighbors have fleeced from our pockets. If they don't sell to us, they will

end up longer than dirk digler on six viagra.

If you want to point a finger at the true energy villains of

2000, it isn't ENE or any other trading concern here, it is Powerex. Too bad we

stopped at the 49th parallel.

CARE continued to

research these allegations and found the following information.

While checking BC

Hydro documents[4] we found that 2,000 MW of transmission

capacity was available for export where it states.

“When: North to South: The

3150 MW path rating was established in December 1997.

South to North: The 2000 MW path rating was

established by internal studies conducted jointly by B.C. Hydro &

Bonneville Power Administration.

System Conditions:

North to South: Studies were conducted on the heavy load summer and light load spring conditions. The ability of B.C. Hydro to deliver 3150 MW is limited only when its system load is above 6300 MW. This limitation is usually only during on-peak hours over the winter months.”

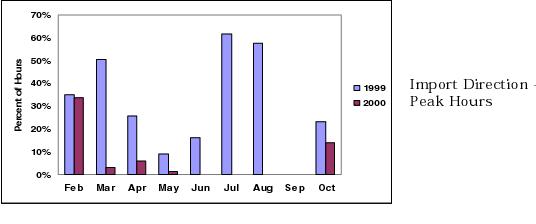

Figure 1 shows that during the two year

period of January 1999 to January 2001 BC

Hydro had available load capacity in the

last six months of 2000 that was equivalent or greater than that available in

1999. Despite this, in information obtained from the Cal-ISO, CARE has verified

that BC Hydro, and its FERC marketer PowerEx, were able to

withhold ~2,000 MW over a six month period in 2000 to drive up the clearing price for power they sold in California. Figure 2, from the Cal-ISO on California Oregon Intertie Congestion Frequency demonstrates that while BC Hydro had more than enough load Capacity, they failed to import significant power during the months of May, June, August, and September 2000.

In

a 4-11-01 LA Times News Article titled Energy Cost Study Critical of Public

Agencies Too, by Robert Lopez and Rich Connell states,

“A confidential document obtained by The

Times names power providers that have allegedly manipulated the electricity

market. While the document does identify out-of-state merchants criticized for

gouging, it also discloses for the first time the extent to which public

entities allegedly have maximized profits in the volatile spot market.

The document--which decodes the identities of unnamed

suppliers in a recent state study--singles out three government-run agencies as

consistently trying to inflate prices. They are: the DWP, the federally owned

Bonneville Power Administration in the Pacific Northwest and the trading arm of

Canada's BC Hydro in British Columbia”

This news article also states,

“ The study by the California Independent System Operator, or

Cal-ISO, analyzed thousands of hours of bidding practices for 20 large

suppliers in the spot, or "real-time," market from May to November.

The study accounted for factors such as rising production costs, increased

demand, periods of scarcity and profits that would be earned in a healthy,

competitive market.

Money earned above that was called excess profits.

No entity--public or private--earned as much in alleged excess

profits as British Columbia's Powerex, the state records show.

"They were the most aggressive bidders," said Anjali

Sheffrin, author of the coded study.

"They had the most amount to bid and

the most freedom to bid it in," said Sheffrin, who did not discuss any

companies by name.

BC Hydro’s rate schedule lists the average price for power it produces for its domestic customers as $0.0577/kwh[5] which is a fraction of what PowerEx’s clearing price was for sales in the Cal-ISO control area. The Cal-ISO report titled, The Firm Transmission Rights Market Review of the First Nine Months of Operation February 1 – October 31, 2000 Prepared by the Department of Market Analysis California Independent System Operator November 30, 2000 lists PowerEx as the marketer with the highest clearing price in the ISO control area with a price $2.25/kwh. The Commission has a statutory duty to protect consumers from unjust and unreasonable rates[6]. The Commission may only allow market-based pricing when there is empirical evidence showing that the market is capable of restraining prices to just and reasonable levels. The Commission has found that in California, rates have been, and have the potential to continue to be, unjust and unreasonable. The Commission has failed to take immediate action to create certainty in the market through the enforcement of its statutory responsibility to protect consumers from unjust pricing, while protecting reliable delivery of power. The Los Angeles Times

Table 1 BC Hydro's Residential

Rate Schedule |

||||||||

article previously sited points to the discrepancy in pricing between BC Hydro’s domestic rates and rates to California’s consumers where it states,

“But BC Hydro

officials acknowledge that they did anticipate periods of severe power

shortages and planned for them by letting their reservoirs rise overnight and

then opening them to create hydroelectricity, which could be produced

inexpensively but sold for a premium.

"It was the marketplace that determined what the price of

electricity would be at any given time," said BC Hydro spokesman Wayne

Cousins. "We helped keep the lights on in California."

And the rates low for their own customers. During the past

year, BC Hydro has stashed hundreds of millions dollars in a "rainy

day" account to ensure that it has among the lowest rates in North

America.”

BC Hydro’s PowerEx apparently exercised “market power” in violation of the FPA. Additionally these actions violated article 605 of the North American Free Trade Act (NAFTA), which states,

“Subject to Annex 605 b), a

Party may adopt or maintain a restriction otherwise justified under Articles

XI:2(a) or XX(g), (i) or (j) of the GATT with respect to the export of an

energy or basic petrochemical good to the territory of another Party, only if

the Party does not impose a higher price for exports of an energy or basic

petrochemical good to that other Party than the price charged for such good

when consumed domestically, by means of any measure such as licenses, fees,

taxation and minimum price requirements.”

The remedies that CARE is seeking

The FERC make findings pursuant to the FPA

Section 202(c)[7] that “an

emergency exists by reason of a sudden increase in the demand for electric

energy, or a shortage of electric energy or of facilities for the generation or

transmission of electric energy, or of fuel or water for generating facilities,

or other causes, the Commission shall have authority, either upon its own

motion or upon complaint [by CARE], with or without notice, hearing, or report,

to require by order such temporary connections of facilities and such

generation, delivery, interchange, or transmission of electric energy as in its

judgment will best meet the emergency and serve the public interest.”

Under such emergency authority the US

government should tax invoke an excise tax on imported energy from Canada to

recoup the billions our neighbors have fleeced from our pockets.

Under

such emergency authority the FERC should demand immediate refunds for

overcharges by BC Hydro, PowerEx, Mirant[8],

and the Bonneville Power Administration.

Under such emergency authority the US

Government should seek enforcement and just compensations for damages resulting

from BC Hydro, PowerEx, and the Bonneville Power Administration’s violations of

the FPA, and seek enforcement of NAFTA article 605 (b) in the international

court.

![]()

Michael E. Boyd – President, CARE 4-12-01